The Emperor's New Blockchain Art?

It seems everyone's jumping on the blockchain bandwagon, promising to revolutionize everything from supply chains to, yes, even art. I recently came across an invitation for a free trial related to blockchain, and it got me thinking: is this technology actually delivering on its promises, or is it just the latest shiny object distracting us from fundamental issues?

The Allure of the New

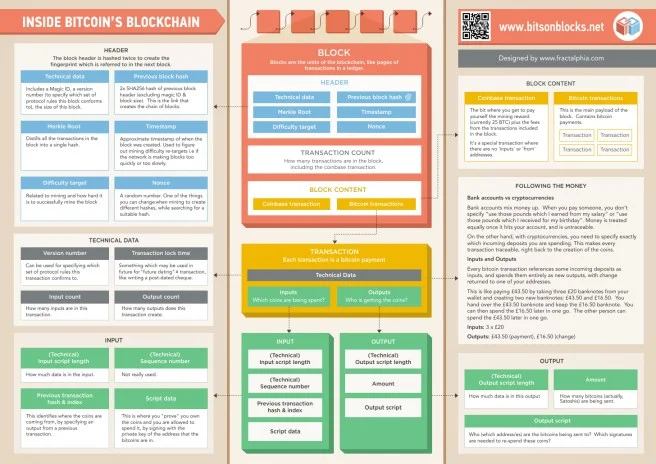

The hype around blockchain is undeniable. We’re told it’s secure, transparent, and decentralized – the perfect solution for an art world often plagued by opacity and questions of provenance. A former Sotheby's chief executive even weighed in, presumably adding to the perceived legitimacy. But let's be honest, celebrity endorsements don't equal technological validity. How many people touting "blockchain art" actually understand the underlying technology, its limitations, and its potential vulnerabilities?

The core problem is that the art world, like many others, is being sold a solution before clearly defining the problem. What specific issues is blockchain uniquely positioned to solve in the art market? Is it authentication? Provenance tracking? Fractional ownership? Or is it simply a way to generate buzz and attract investment? I suspect it’s more of the latter.

Where's the Data?

Here's where my skepticism kicks in. If blockchain is truly revolutionizing art, we should see concrete data points: a measurable decrease in art fraud, a significant increase in market efficiency, or a demonstrable shift in artist compensation. But where is this data? I've looked, and I haven't found it. (And this is the part of the analysis that I find genuinely perplexing.)

Instead, we get vague promises and theoretical benefits. We're told that blockchain can create immutable records of ownership, preventing forgeries and simplifying transactions. That sounds great in theory, but what about the real-world complexities of the art market? What about subjective assessments of authenticity, the role of expert opinions, and the legal frameworks that govern art ownership? These factors aren't easily encoded into a blockchain.

And what about the environmental impact of blockchain? The energy consumption of some blockchain networks is substantial (Bitcoin, for example, consumes more electricity than some entire countries). Is the art world truly ready to embrace a technology with such a significant carbon footprint, especially when the purported benefits remain largely unproven?

A Dose of Reality

The truth is, the art world has always been driven by a mix of genuine appreciation, speculative investment, and good old-fashioned hype. Blockchain art is just the latest iteration of this dynamic. It's a new technology being applied to an old problem, and the results so far are far from conclusive.

I'm not saying that blockchain has no potential in the art world. But I am saying that we need to approach it with a healthy dose of skepticism and a demand for concrete evidence. Let's move beyond the buzzwords and the celebrity endorsements and focus on the data. Let's see the numbers, the metrics, and the real-world impact before we declare blockchain the savior of the art market. Otherwise, we risk getting caught up in another overhyped trend that ultimately benefits only a select few.